Visualization and Tools for Ichimoku Kinko Hyo Strategies

An implementation of ‘Ichimoku Kinko Hyo’, also commonly known as ‘cloud charts’. Static and interactive visualizations with tools for creating, backtesting and development of quantitative ‘ichimoku’ strategies. As described in Sasaki (1996, ISBN:4925152009), the technique is a refinement on candlestick charting, originating from Japan and now in widespread use in technical analysis worldwide. Translating as ‘one-glance equilibrium chart’, it allows the price action and market structure of financial securities to be determined ‘at-a-glance’. Incorporates an interface with the OANDA fxTrade API https://developer.oanda.com/ for retrieving historical and live streaming price data for major currencies, metals, commodities, government bonds and stock indices.

Install ichimoku from CRAN:

install.packages("ichimoku")library(ichimoku)Simply ichimoku() and plot():

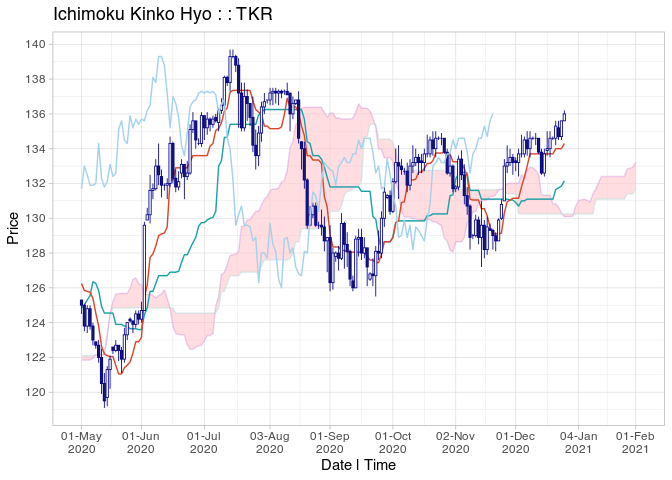

cloud <- ichimoku(sample_ohlc_data, ticker = "TKR")

plot(cloud, window = "2020-05/")

autostrat() to automatically evaluate and rank

top-performing strategies:

autostrat(cloud, n = 3)

#> [,1] [,2] [,3]

#> Strategy "senkouB > tenkan" "cloudB > tenkan" "senkouB > kijun"

#> --------------------- "----------" "----------" "----------"

#> Strategy cuml return % 17.49 16.08 14.1

#> Per period mean ret % 0.0906 0.0838 0.0741

#> Periods in market 63 51 64

#> Total trades 3 3 3

#> Average trade length 21 17 21.33

#> Trade success % 100 100 100

#> Worst trade ret % 3.64 3.16 3.49

#> --------------------- "----------" "----------" "----------"

#> Benchmark cuml ret % 5.53 5.53 5.53

#> Per period mean ret % 0.0302 0.0302 0.0302

#> Periods in market 178 178 178

#> --------------------- "----------" "----------" "----------"

#> Direction "long" "long" "long"

#> Start 2020-04-20 2020-04-20 2020-04-20

#> End 2020-12-23 2020-12-23 2020-12-23

#> Ticker "TKR" "TKR" "TKR"ichimoku()

- to create an ichimoku object from price data.

plot()

/ iplot()

- to plot (interactive) cloud charts from ichimoku objects.

archive()

- for reading/writing objects to/from archive files with data

verification.

oanda()

- to retrieve price data from the OANDA fxTrade API.

strat()

- to augment an ichimoku object with a strategy, including combined and

asymmetric strategies.

autostrat()

- to automatically evaluate and rank top-performing strategies.

mlgrid()

- to generate a numeric representation of the ichimoku cloud

chart.

relative()

- to produce a statistical summary of the latest ichimoku numeric

representation relative to historical values.

oanda_chart()

- to plot real-time ichimoku cloud charts using OANDA data.

oanda_studio()

- a complete live analysis environment using OANDA data implemented in R

Shiny.

oanda_stream()

/ oanda_quote()

- to obtain the latest live data stream / quote from the OANDA fxTrade

API.

oanda_view()

- for a market overview showing the relative performance of

constituents.

oanda_orders()

/ oanda_positions()

- to retrieve the aggregate OANDA fxTrade order / position

book.

Long-form documentation links:

{ 1 } Cloud Charts - The Reference Manual

{ 2 } Beyond Visualization - Quantitative Strategies

{ 3 } Auxiliary Functions

{ 4 } The OANDA fxTrade API

Sasaki, H. 佐々木 英信 (1996), 一目均衡表の研究 [ichimoku kinkouhyou no kenkyuu]. Tokyo, Japan: Toushi Radar.

‘OANDA’ and ‘fxTrade’ are trademarks owned by OANDA Corporation, an entity unaffiliated with the ichimoku package.

–

◈ ichimoku R package: https://shikokuchuo.net/ichimoku/.

Listed CRAN Finance Task View: https://cran.r-project.org/view=Finance.

–

Please note that this project is released with a Contributor Code of Conduct. By participating in this project you agree to abide by its terms.